Critical Illness Cover | Haven Financial Solutions

Critical Illness Cover (also sometimes referred to as CIC or Serious Illness Cover) is a policy that will pay you a lump sum if you are diagnosed with a critical/serious illness specified by the policy. Critical/serious illnesses are things such as some cancers, heart attack, stroke, organ failure, etc.

Some CIC policies also pay out on earlier death.

The policy is really valuable during a difficult time following the news of a diagnosis. It can allow you or your partner to take time off work to be able to attend appointments, receive treatment and recover without having to worry about how the bills are going to be paid.

There are commonly two levels of cover depending on your budget. There is standard cover and an enhanced option which covers a more comprehensive list of conditions, e.g. early grade cancers or type 1 diabetes. These tend to vary dependant on which insurer is chosen, and so we always recommended discussing your situation with a specialist who can advise / recommend the right policy or insurer for you.

Some insurers also include children's cover as standard or it can be added or enhanced for an additional monthly fee (where it is not automatically provided). This cover will pay out if your child gets diagnosed with one of the listed illnesses, allowing you to take time off work to take care of them or pay for specialist treatment.

or call us on

01202 082 380

![]()

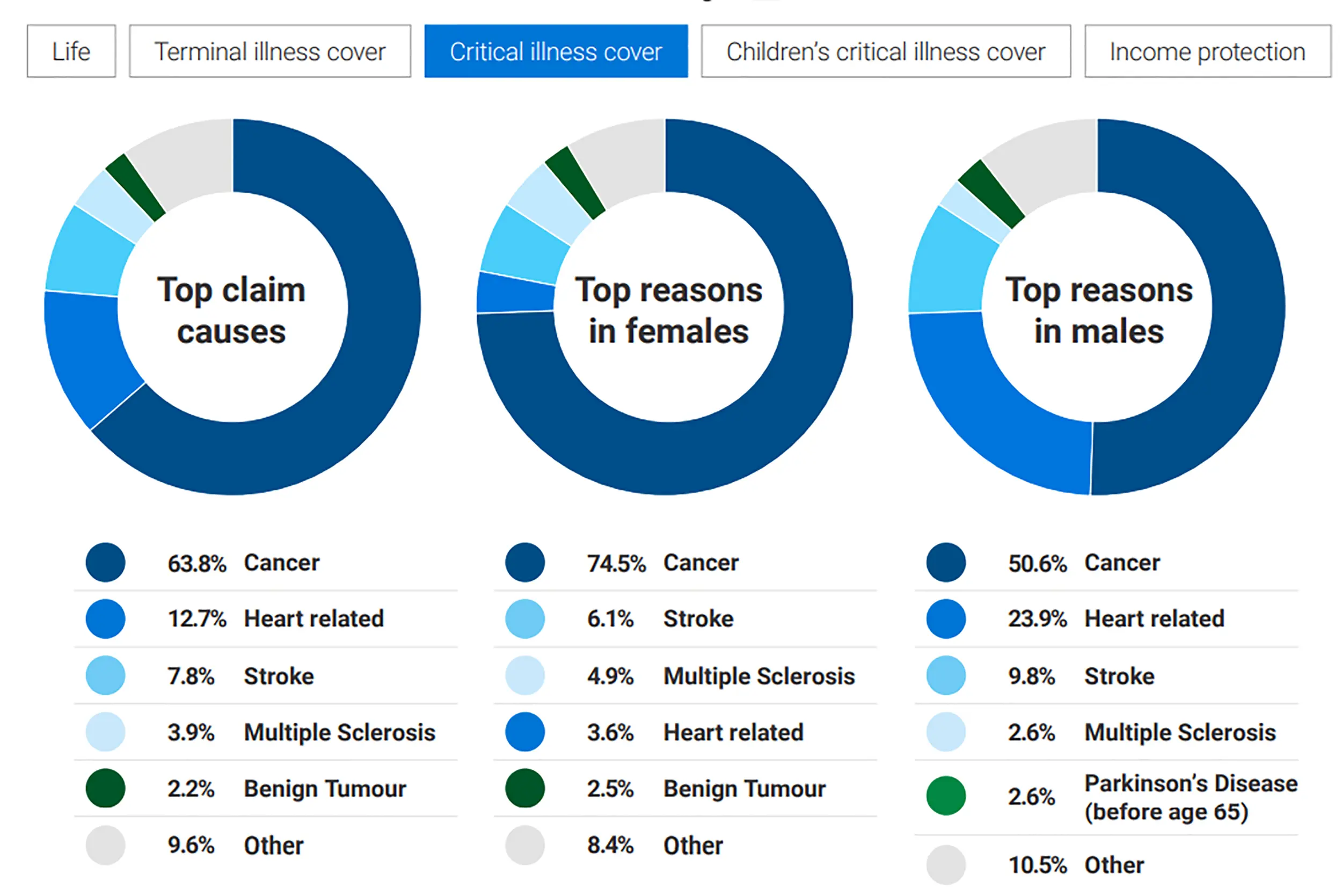

The most common claims on Critical Illness Cover are Cancer, Heart conditions and Stroke.

*source – Legal & General published claims information based on claims 01/01/22 to 31/12/22

Get In Touch

Haven Financial Solutions Ltd.Head Office

Arena Business Centre

Holyrood Close

Poole

BH17 7FJ

01202 082 380

info@havenfs.co.uk